2024 Form 1040 Schedule A Pickup – To take advantage of homeowner tax deductions, you’ll need to itemize your deductions using Form 1040 Schedule A. Your decision to itemize will depend on whether your itemized deductions are . You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. .

2024 Form 1040 Schedule A Pickup

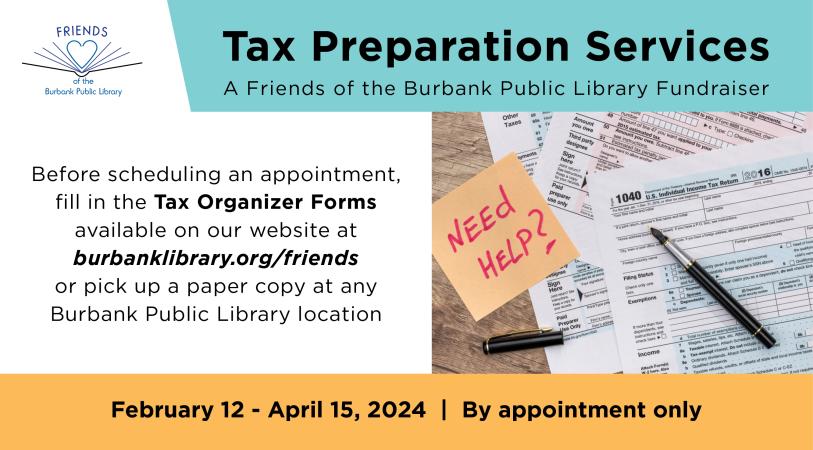

Source : burbanklibrary.orgIRS Announces Standard Mileage Rates for 2024

Source : www.farmcpareport.com2024 Ford Ranger® Truck | Pricing, Photos, Specs & More | Ford.com

Source : www.ford.com2024 Ford F 150® Truck | Pricing, Photos, Specs & More | Ford.com

Source : www.ford.comBoyertown Community Library | Boyertown PA

Source : www.facebook.comTax Forms Are Now Available at the Library! – Franklin Township

Source : www.franklintwp.orgIRS Collection Notices to Re Start in 2024 Foodman CPAs and Advisors

Source : foodmanpa.comKari Strang Tax & Accounting LLC | Shullsburg WI

Source : www.facebook.comStop by the Eagle Public Library lobby and pick up your tax forms

Source : www.instagram.comNew Commercial Trucks | Find the Best Ford® Truck, Pickup, Chassis

Source : www.ford.com2024 Form 1040 Schedule A Pickup Home | Burbank Public Library: AmVets’ pickup process is usually simple itemize your donations on your federal tax return using Form 1040 (Schedule A). Report the total value of your donated furniture under the . Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule D, or crypto income either on Form 1040 Schedule C for self-employment earnings or Form 1040 .

]]>